Hyperliquid vaults - the search for alpha

Went through all vaults in Hyperlid, looking for alpha … The average crypto participant couldn’t care less about it but if all I want is beta I’d rather just buy BTC. In traditional finance markets, it’s very hard to do this kind of analysis but , in crypto, vaults provide a very interesting opportunity. Obviously alpha is scarce but the data is out there for us to look at in a way that doesn’t exist in tradfi.

Methodology

- Retrieved data for all vaults and compute capital adjusted percentage returns. The goal was to adjust for capital changes which are frequent in vaults

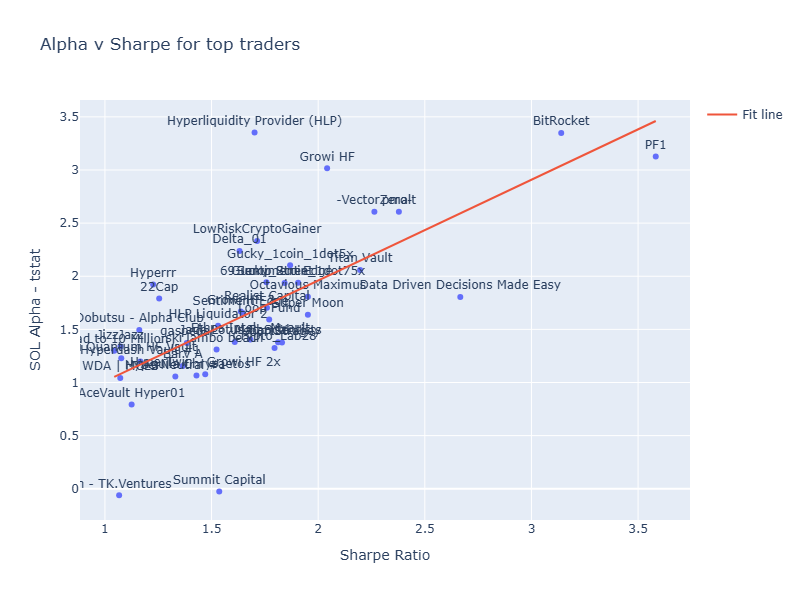

- Compute alpha vs both SOL & Beta

- Compute sharpe

- Look for high sharpe traders that have ~ statistically significant across SOL & BTC

- Filter for traders with > 10k usd. Realistically I won’t be comfortable to hand over my money to someone trading a very small amount of money

- Filter for >120 days of trading

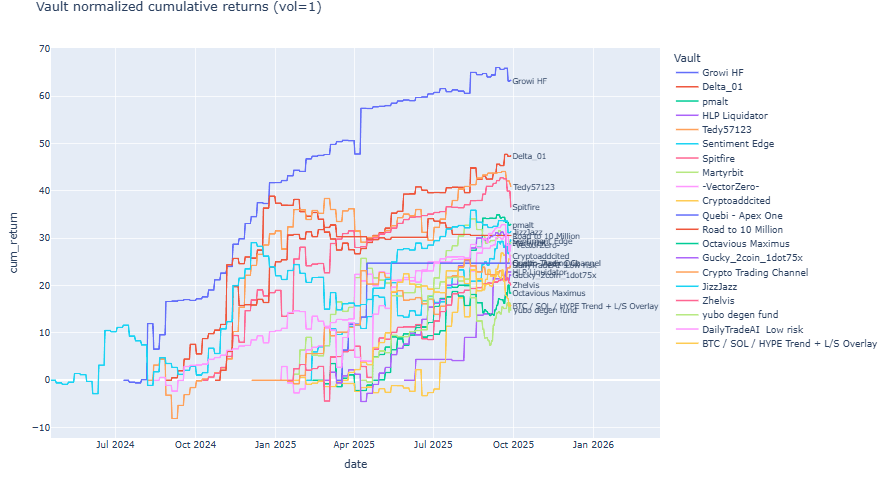

Key stats for the top performers :

| Name | TVL (kUSDT) | Sharpe Ratio | Gain % | SOL Alpha - tstat |

|---|---|---|---|---|

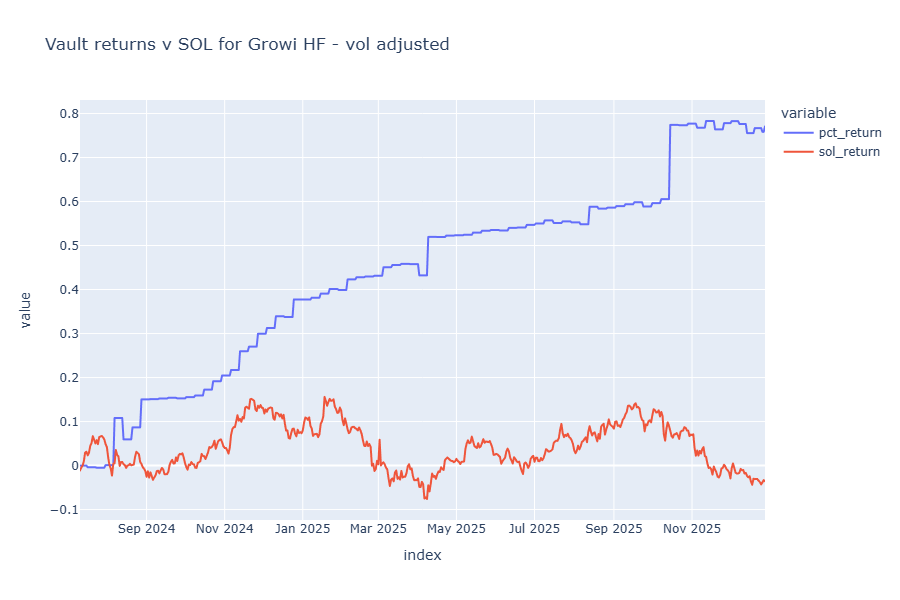

| Growi HF | 3053 | 2.3 | 77 | 3 |

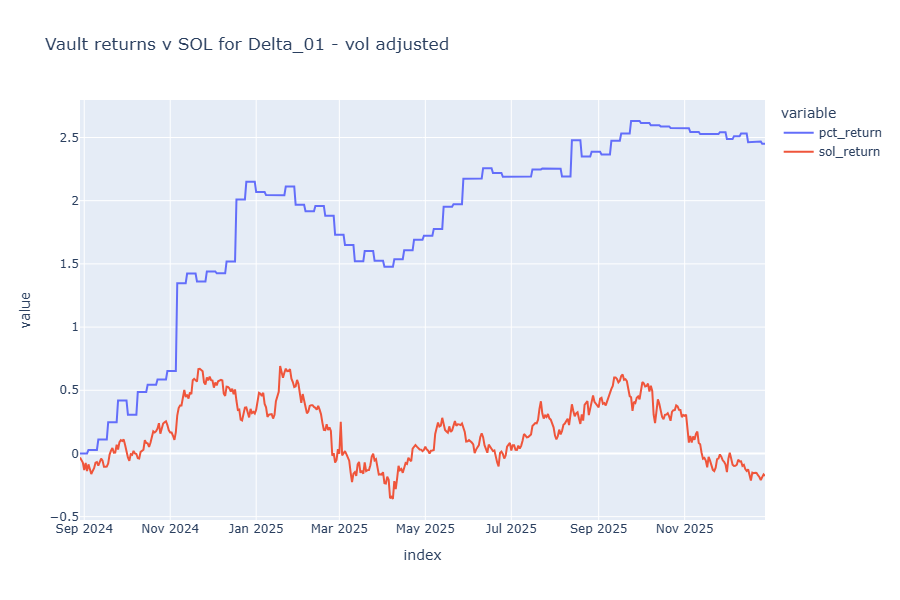

| Delta_01 | 812 | 1.9 | 1273 | 2.3 |

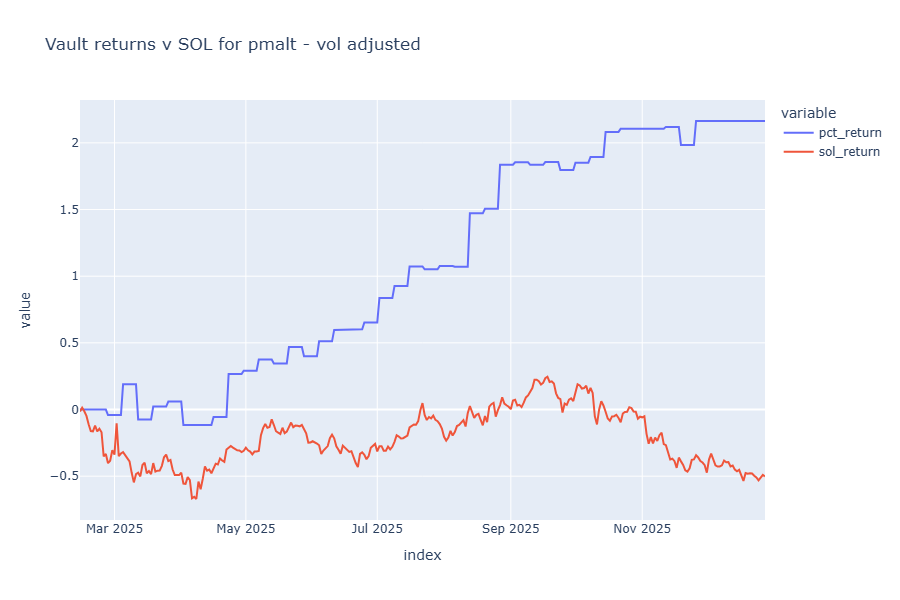

| pmalt | 119 | 2.5 | 484 | 2.2 |

| HLP Liquidator | 599 | 2.6 | 146493 | 2 |

| Tedy57123 | 22 | 1.7 | 173 | 2 |

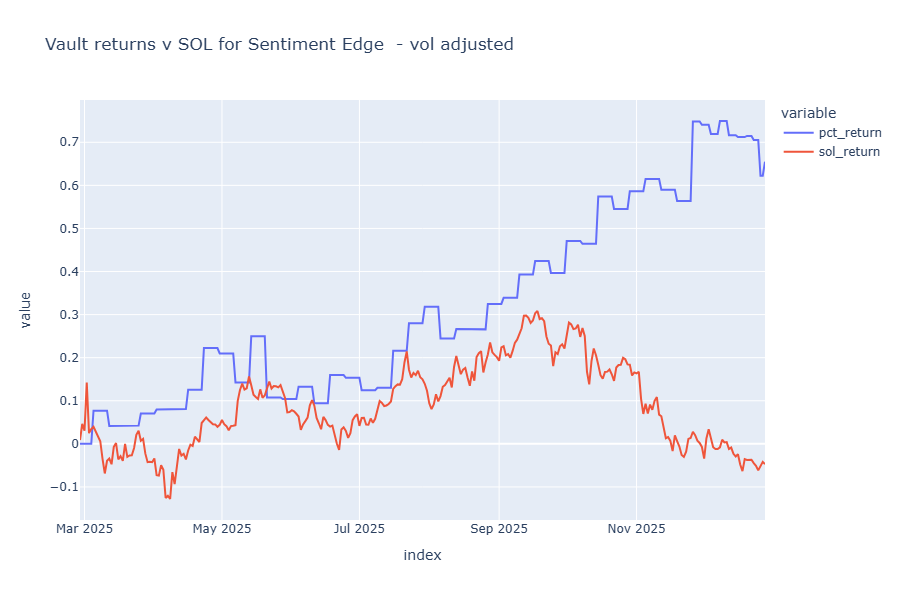

| Sentiment Edge | 60 | 2.2 | 91 | 1.9 |

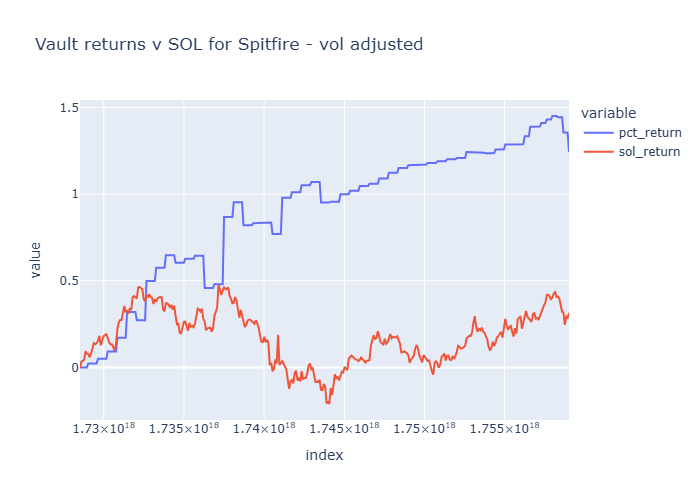

| Spitfire | 1074 | 1.8 | 246 | 1.9 |

| Martyrbit | 972 | 1.9 | 27 | 1.8 |

| -VectorZero- | 17 | 1.8 | 79 | 1.8 |

| Cryptoaddcited | 140 | 1.8 | 48 | 1.7 |

| Quebi - Apex One | 12 | 2 | 8 | 1.7 |

| Road to 10 Million | 180 | 1.5 | 123 | 1.6 |

| Octavious Maximus | 12 | 2.1 | 345 | 1.5 |

| Gucky_2coin_1dot75x | 14 | 1.8 | 41 | 1.5 |

| Crypto Trading Channel | 71 | 1.3 | 16 | 1.4 |

| JizzJazz | 54 | 1.2 | 177 | 1.3 |

| Zhelvis | 13 | 1.5 | 134 | 1.3 |

| yubo degen fund | 125 | 1.6 | 77 | 1.2 |

| DailyTradeAI Low risk | 428 | 1.1 | 87 | 1.2 |

| BTC / SOL / HYPE Trend + L/S Overlay | 50 | 1.4 | 29 | 1.1 |

Some vaults like Growi 01, Delta_01, pmalt, Sentiment Edge & Spitfire look very interesting - high sharpe with statically significant alpha.